Super Bowl Biz

10 February 2023

Hi, The Investor’s Podcast Network Community!

📈 Stocks’ scorching start to 2023 cooled off slightly, at least for now, ahead of Tuesday’s January CPI report. It will be the first major read on inflation in 2023. Will the hot start continue into Valentine’s Day?

Lyft’s stock fell 36% after a “debacle” of an earnings report, though earnings overall have mostly held up across the major averages.

And, on Sunday, many Americans will be locked in on the Chiefs-Eagles game as Philadelphia looks to win its second Super Bowl in five years. More on that below 🏈

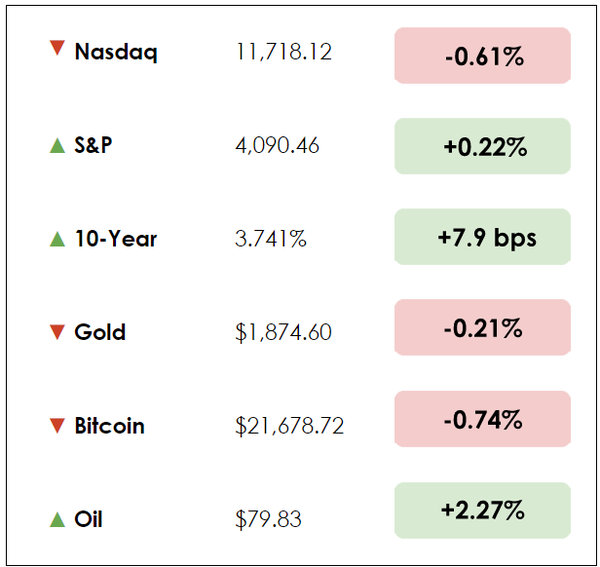

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Russia’s retaliatory cut in oil production

- Wall Street’s tight connection with crypto

- Plus, our main story on the incredible business of the Super Bowl

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

✂️ Russia Cuts Oil Production (Bloomberg)

Explained:

- Russia announced plans to cut its oil output by 500,000 barrels per day next month in response to Western sanctions, sending oil prices higher.

- The move is apparently in response to import bans and price caps on Russian oil from the European Union: “Russia believes that the mechanism of price caps on Russian oil and petroleum products is an intervention in market relations and an extension of destructive energy policies of the collective West,” said Russia’s Deputy Prime Minister Alexander Novak.

- While the Russian government frames the move as a voluntary reduction, others think differently. One analyst from UBS wrote, “We believe the decision isn’t a completely voluntary one…as market factors likely forced the Russian side to make this decision.”

Why it matters:

- Analysts expected that the exodus of American and European oil companies from Russia would weigh on the country’s ability to maintain oil production, given its dependence on Western technology and skilled labor. However, this reality may be manifesting sooner than anticipated.

- Whether it’s an intentional move in response to sanctions or the result of declining Russian industrial capacity, energy markets will be getting tighter regardless.

- Although Russian oil output has proven resilient, rising from a post-invasion low of 10 million barrels per day in April to almost 11 million at the end of 2022, Moscow’s oil revenues have taken a hit thanks to price cap sanctions that limit the price it can sell oil for in foreign markets — Russia’s main export grade of crude oil, Urals, trades at a considerable and widening discount to international benchmarks.

🏦 World’s Most Traded Crypto Runs Through Wall Street (WSJ)

Explained:

- After years of speculation, new details are emerging about the stablecoin tether and how it stores the billions of dollars of U.S. Treasury bonds that underpin its peg to the dollar.

- Tether Holdings Ltd., the secretive Hong Kong-based owner of the stablecoin (a cryptocurrency with its value tied to another currency), has been using Cantor Fitzgerald to oversee its $39 billion bond portfolio since late 2021, according to the Wall Street Journal.

- The company has faced intense scrutiny over how it manages tether’s underlying assets. Some believe it lacks the collateral to ensure that each outstanding tether token can be redeemed for $1 in a crisis.

- Tether is the third-largest cryptocurrency by market cap and the most traded by volume. Given its systemic role in the crypto economy, such accusations add further uncertainty to an asset class already ripe with controversy.

Why it matters:

- Cantor’s oversight of the massive bond portfolio illustrates a willingness to look past significant regulatory and governance concerns. Other firms have been more cautious about engaging with Tether’s business, like Wells Fargo, which stopped processing the company’s wire transfers in 2017.

- Angst around Tether has stemmed from reports suggesting that 86% of the company is owned by just four men with little relevant financial experience. Some allege fraud, but more generously, this has undoubtedly created blunders, with the company paying a $61 million fine in 2021 to settle two investigations that found it had regularly misrepresented the true state of its reserve between 2016 and 2019.

- Tether has never released audited financials, but by hiring Cantor, the stablecoin company is getting a Wall Street partner that’s “deeply entrenched in the Treasury market,” providing legitimacy to its operations that have grown to a size that extends well beyond crypto and may materially impact the U.S. Treasury market.

WHAT ELSE WE’RE INTO

📺 WATCH: Howard Marks shares his blunt advice on investing

👂 LISTEN: Unconventional wisdom from the greatest minds in investing

📖 READ: Why Chiefs QB Patrick Mahomes might be the NFL’s $500 million bargain

MAIN STORY: THE SUPER BOWL

The Super Bowl has transformed from a relatively popular game in the late 1960s to what is essentially a gigantic market in itself.

In 1967, the cost of ads for the first Super Bowl was just $40,000.

The cost of a commercial during this Sunday’s big game is around $7 million for a 30-second spot—about three times what it was in 2007. That comes despite a steady drop in television viewership.

It would take the average American over 100 years to earn enough money to purchase a single ad.

Plus, the average cost of attending is north of $6,000 per seat, with luxury boxes well into six figures.

Let’s dive into the big business of America’s big game.

A branding mecca Roughly 200 million people from around the world will watch the game. Some of the world’s most popular musicians perform the most elaborate sets of their careers.

The ads shown during the Super Bowl are as much of a draw as the game itself. And because it’s usually the single most watched broadcast of the year, the ads are very expensive.

The Super Bowl ad market is around $300 billion, about twice what the U.S. federal government spends on education per year.

For the first time in a decade, Pepsi will not sponsor the Super Bowl Halftime Show. Apple took over that spot, signing a contract for the next five years worth $50 million a year.

Anheuser-Busch InBev, the company that owns brands like Budweiser and Michelob Ultra, has had an exclusive sponsorship deal worth $250 million annually to sponsor the Super Bowl since 1989.

Every year since the game started, without exception, well over half of American households with a TV tuned in. In many cases, more than three-quarters tuned in. (1976 marked a record 78% share.)

How did it become a cultural phenomenon?

Experts say the NFL’s rise coincided with the growth of TV. In 1955, only half of American households had a TV set. By 1967, the year of the first Super Bowl, 93% of U.S. households had a TV.

It might be as simple as an American audience hungry for big spectacles to watch communally, and the NFL gave it to them.

The game is also synonymous with “patriotism.” Almost immediately after the Super Bowl started, the NFL wrapped itself in the American flag and initiated a close relationship with the US military, hoping to turn the spectacle into a holiday.

Since then, the game has been a celebration of both the sport and the country. Part of football’s terminology – trenches, blitz, bomb – is even borrowed from the language of warfare.

Major markets

Teams from major media markets dominated the early Super Bowls, helping amplify the stage of the big game: the Dallas Cowboys, Miami Dolphins, and Pittsburgh Steelers all shined.

In the 1970s, The Cowboys, Dolphins, and Steelers combined to win seven of the 10 Super Bowls that decade. The NFL also leaned into the growing celebrity of its best players, including Namath, Terry Bradshaw, Walter Payton, and O.J. Simpson.

The 1980s marked the rise of even more big-market teams, like the New York Giants, Chicago Bears, Washington Redskins, and San Francisco 49ers—all of which won at least one Super Bowl during the decade.

Advertisers took notice, realizing they had a massive TV audience they couldn’t find anywhere else, thanks to star power and large followings.

In 1978, the NFL moved the Super Bowl to primetime in the US eastern time zone for the first time, in part to please the growing number of advertisers seeking the valuable ad space. The result was the most-watched Super Bowl broadcast to date, jumping 27% in total viewers from the year prior—by far the largest year-to-year increase in the game’s history.

That was perhaps the year the Super Bowl went from an already enormous event into a permanent staple of American culture.

Today, many Americans watch the Super Bowl for the ads as much (or more than) they do for the game itself. This trend might be traced to Apple’s famous 1984 ad in which the young technology company introduced the Macintosh computer to the world. It’s still considered one of the best commercials of all time.

The ad set the bar high for turning the Super Bowl from a game into a business.

Dive deeper

Readers, we’d love to hear. What’s your favorite part of the Super Bowl? Are you picking the Eagles or the Chiefs?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.