Just Do It

21 December 2022

Hi, The Investor’s Podcast Network Community!

Well, the bulls aren’t ruling out a Santa Claus rally quite yet 🎄

Markets finished up for the second straight day after last week’s selloff. Each of the S&P 500’s eleven sectors closed in the green as consumer confidence data about the economy and labor market jumped to its highest level since April.

Inflation expectations for the year ahead also dipped to 6.7% — the lowest in more than a year.

Meanwhile, Ukrainian President Volodymyr Zelensky is in D.C. meeting with President Biden as the war in Ukraine rages on.

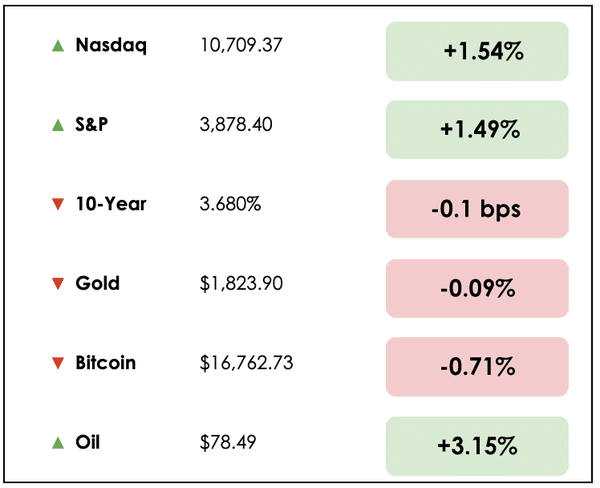

Here’s the rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Strong earnings from Nike, and Apple’s latest moves to keep its production of iPhones and MacBooks operating smoothly, plus our main story on trend following as an investment strategy.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

👟 Nike Earnings Surprise (FT)

Explained:

- Nike (NKE) shares jumped Wednesday after the sportswear company raised its revenue-growth outlook and reported better-than-expected quarterly results.

- In what was widely viewed as a surprise, Nike said its inventory challenges are abating because it successfully used discounts to clear out excess merchandise.

- Nike raised its outlook into 2023 and expects full-year revenue to grow by a percentage in the “low teens” (excluding currency fluctuations).

Why it matters:

- Many consumers have shifted discretionary spending as persistent inflation pounds their budgets. However, “Nike’s results show that consumer demand remains very strong for the brand, which is a positive for the wider athleisure market given its scale,” an analyst at Investec said.

- Supply chain issues had pinched Nike’s growth since the pandemic began, a problem that impacted nearly the entire retail space.

- While Nike is still recovering from lockdowns in China and factory closures, the report offered hope for the company’s future sales, though it remains to be seen whether firms with less brand loyalty can weather a weaker global economy.

💻 Apple Shifts From China (CNBC)

Explained:

- Apple (AAPL) will begin producing some of its MacBook computers in Vietnam rather than China.

- Apple could start this transition as soon as May 2023 as it looks to diversify operations amid U.S.-China trade tensions and supply chain disruptions.

- Apple makes about 20 million to 24 million MacBooks each year. The company already has some iPhone production in India and might begin building AirPods there, too.

Why it matters:

- Just as Nike has faced enormous supply chain challenges and issues with China’s lockdowns, Apple has encountered supply chain issues of its own.

- The world’s largest iPhone factory, run by Foxconn, is located in China. A Covid outbreak in October caused workers to flee the facility and spawned violent protests.

- All of the above could impact Apple’s December sales, historically the company’s biggest quarter amid the holiday shopping season.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: How to read 100 books a year — 8 tips for reading more.

👂 LISTEN: How Jeff Bezos built Amazon, with Clay Finck.

📖 READ: Airlines move to offer free wifi.

RECOMMENDED READING: ALTS

Let me guess: Your portfolio is down?

Same here. The S&P is down. The NASDAQ is down. And crypto is down.

But did you know that farmland is completely unaffected. Or that comic books are way up? Or that vinyl records are mooning?

That’s why we’ve been reading Alts. These guys analyze the heck out of alternative assets, and you reap the rewards.

Join 50,000 others and see what you’ve been missing.

THE MAIN STORY: TREND FOLLOWING

Overview

If you’re a frequent listener of our podcasts or reader of this newsletter, you’ve probably got a solid grasp on ‘fundamentals’ style investing, where decisions are based on companies’ financial performance.

There are many ways to invest well, though. One other approach is known as trend following.

And it’s had a pretty remarkable year. The SG Trend Index is up 36% through September, whereas a global portfolio of 60% bonds and 40% stocks would’ve been down 20% over the same time.

That’s an incredible differential.

What is trend following?

Trend following uses technical analysis (price charts, moving averages, volume, etc.) to find momentum-based opportunities in markets.

Some 200 years ago, the classical economist David Ricardo said to “cut short your losses” and “let your profits run on.”

This, in essence, is trend following.

The strategy builds on a well-known market principle: financial assets are susceptible to “trending” in one direction or another for periods.

This can extend as broadly as entire asset classes and sectors or to single stocks, hence the axiom about never trying to “catch a falling knife.”

Momentum

That phrase taps into the same thinking as trend following: an investment’s momentum can (rationally or irrationally) compound overwhelmingly in one direction.

While value investors may see a strong underlying business that’s stock is subjected to a brutal selloff, they can also get burned by stepping in too early to buy its shares.

Regardless of the reason, when a wave of selling pushes prices down, this begets more selling as investors panic, creating a downward spiral.

Warren Buffett would tell us that such an event offers us discounts on owning a business.

That’s true, but for us mortals subject to the pains and vulnerabilities of emotion, losing 20% on an investment within the first month of owning it is torturous. The less certain we are in the company’s future, the more the anguish is magnified.

How it works

Rather than trying to assess the underlying merits of said stock and calculate its intrinsic value, trend followers look for assets simply in one of these spirals.

If they identify a stock that’s aggressively selling off, they may go short and add to the selling, then lock in profits once things stabilize.

In this way, trend followers may try to nimbly jump in and out of a trend, regardless of direction (up or down). That’s why the strategy, when well-executed and disciplined, can prove remarkably robust and perform well during both bull and bear markets.

Outlook

The quantitative hedge fund AQR believes that “both the macroeconomic picture and empirical evidence suggest that strong performance for trend-following may persist, making it a potentially valuable source of diversifying returns during a challenging time.”

There are many different niches in trend following and even more ways to construct an investment approach with it as a strategy.

Still, it’s employed everywhere, from soybean futures markets to Bitcoin to the S&P 500.

A basic but well-known approach is called “time-series momentum,” where a trend follower would go long markets/assets with recent positive returns and short those with recent negative returns.

Takeaways

In one study, AQR found that going back to 1880, trend-following investing has performed well in each decade for more than a century, adding “significant diversification benefits to a traditional allocation.”

The conclusion was that “trends are pervasive features of global markets.”

Dive Deeper

You can read AQR’s latest write-up in favor of trend following here to learn more.

We’ve also done past podcasts on the topic. Check out our classic interview with Dr. Wesley Gray on blending value investing with trend following.

Tell us, readers — Would you consider adding funds that use trend following to your portfolio?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.