Low Morale

29 September 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

For the six million Americans that suffer from Alzheimer’s, a terrible disease that inflicts seemingly irreversible cognitive deterioration, a new drug study found success in slowing declines by up to 27% for patients 💊

In other news, as markets adjust to higher interest rate projections, the next shoe to drop will be earnings.

Analysts like Michael Wilson of Morgan Stanley are raising concerns that collective earnings estimates for stocks are too high, since projections still show above-average profit growth for companies despite rising odds of a recession.

Should Wall Street realize that its earnings projections are, indeed, too high, then equities will see a lot more pain in their futures 🐻

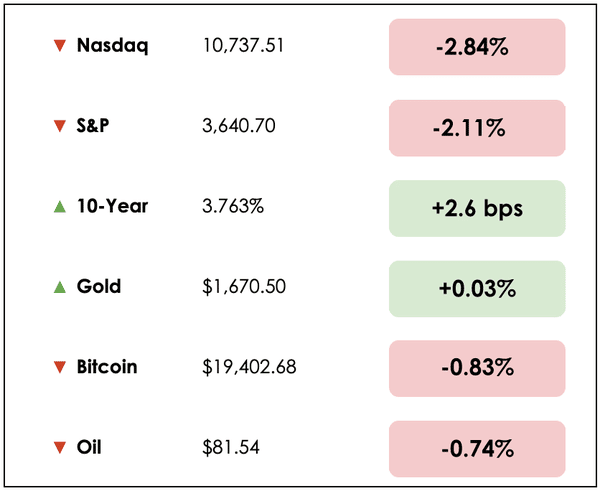

Here’s the market rundown:

*All prices as of market close at 4pm EST

Mr. Market hosted a big sale, with stocks failing to keep any of yesterday’s positive momentum. There’s increasing fear that something in the financial system is due to “break” given the currency, bond, and equity market collapses we’ve seen over the past few weeks.

Today, we’ll discuss Amazon’s wage hikes, China’s moves to protect its currency, inflation’s weight on consumer appetites in Europe, and the joys of compounding.

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

🤑 Amazon Raises Hourly Wage At A Cost Of $1 Billion A Year (Yahoo)

Explained:

- Hourly workers at Amazon (AMZN) locations in the U.S. will see a pay increase that’s set to make the average starting wage north of $19 an hour for warehousing and transportation employees.

- The company said the wage increases will generate additional spending of $1 billion over the next year.

What to know:

- Amazon is the second-largest private employer in the U.S. with 1.1 million workers, behind only Walmart.

- As Amazon faces growing employee activism and union drives at certain facilities, the company hopes that higher wages will satisfy workers’ demands.

🇨🇳 China Intervenes To Protect Its Currency (Reuters)

Explained:

- China’s central bank has requested that large state-owned banks prepare to sell dollars in exchange for yuan in offshore markets to offset the currency’s fall against the dollar.

- State banks with offshore branches around the world, from Hong Kong to New York and London, have been provided with the same instructions for using their dollar holdings to help protect the yuan.

- In a year when the dollar has soaked up global liquidity and surged higher, China joins the growing list of countries seeking to shield their currency from further losses.

What to know:

- Year to date, the Chinese currency has lost more than 11% against the dollar, which sets the stage for its worst annual performance since 1994.

- Following just a 2% devaluation in 2015, China burnt through $1 trillion of its official foreign exchange reserves to stabilize its currency

- The People’s Bank of China has also tried to increase the cost of shorting the yuan this month so as to discourage speculators from further betting against it.

😟 Inflation Weighs On Consumer Morale In Europe (Reuters)

Explained:

- Across the euro zone’s three largest economies, indicators of consumer morale remain subdued, as high inflation shows no sign of retreating.

- For the fourth consecutive month, German consumer sentiment is expected to hit a new record low, and French consumer outlook has once again deteriorated after falling for seven straight months before a slight rally in August broke the trend.

- Italian shoppers were also feeling quite gloomy ahead of the country’s recent elections, as consumer morale indexes for September came in below median analyst forecasts.

What to know:

- According to the Gfk Institute, as many German consumers today fear a recession as they did during the Great Financial Crisis.

- Real income expectations and willingness to buy are dropping rapidly, and should these bleak sentiment reports manifest into actual spending behaviors, then a deep recession in Europe seems unavoidable.

DIVE DEEPER: THE JOYS OF COMPOUNDING

The greatest investors aren’t just incredible money managers, they are also philosophers of life at their deepest core.

People such as William Green, Arnold Van den Berg, Tom Russo, and Guy Spier have all given heavy praise for Gautam Baid’s book, The Joys of Compounding.

Patrick— I am ashamed to say, but I had never heard of Gautam Baid or his book until recently, and it seems I have been missing out.

Baid left his job as a banker in India to pursue his dream of investing in the U.S. He worked the graveyard shift as a hotel clerk before breaking into the investment industry, and he’s now a best-selling author in five countries, while also founding Stellar Wealth Partners.

The book sheds light on the superiority of value investing, but it also provides an intellectual toolkit for achieving an in-depth understanding of both ourselves and the world around us.

According to Baid, you not only want to build a sizable investment portfolio, but you also want to lead a life well-lived. His book provides some fantastic guidelines on how to do that. Let’s explore:

Breaking it down

• Achieve a flow state — Baid says continuous learning and self-improvement are the best investments anyone can make and the effects compound over time. Yet, we live in a world of constant distraction from emails, texts, social media, and continuous bombardment from the news.

It’s more difficult than ever to stay focused. I’ve read that the average person checks their phone 344 times each day — once every four minutes. And it takes 20 minutes to get back into focus after a distraction.

Developing a state of flow is essential for learning and deep work. Baid says the lifetime effects of deep learning are “akin to buying a dollar for less than one cent. This is why good books are the most undervalued asset class: the right ideas can be worth millions.”

• Know when it’s enough — The whole goal of compounding wealth is to be financially independent. However, constantly moving the goalpost and allowing your lifestyle to inflate, can turn the pursuit of wealth into a prison of our own making.

The “hedonic treadmill” causes our expectations and desires to increase as our income does. But, as William James Dawson said, “I saw that it was the artificial needs of life that made me a slave; the real needs of life were few.”

• Simple is best — We are not paid for style points or complexity in investing and often, a simple strategy is the best strategy. Our goal is to compound our capital over time at the highest possible rate with the minimum amount of risk. We can achieve this objective by seeking out undervalued stocks of companies within our circle of competence.

Baid says putting in more time and effort does not necessarily guarantee better results in investing. Instead, it is more beneficial to do less and make fewer but better decisions.

• Buy and hold…and evaluate — It generally pays to be a long-term investor, but that doesn’t mean we buy and hold forever.

Instead, we need to have a process of continually questioning our core thesis on our investments. It is easy to become complacent when stock prices are rising. Continue to evaluate and be careful of calling something a “long-term investment” just because it didn’t work out as planned.

It may be best to jettison a position in which your thesis has turned out to be wrong and be careful of the dangers of commitment and consistency bias which we talked about here.

• The inner scorecard — This is an idea that Warren Buffett promotes. We don’t want to live a life dependent on the approval or good opinion of others.

Instead, we need to have our own internal principles and keep score of our life based on what’s of value to us, not what others say should be of value. And do not seek out external validation. Self-respect beats social approval.

To some degree, we need to be contrarian, reason independently, and resist the pressure to conform.

• Pursue your passion — Life is short and time is fleeting. Baid says we need to pursue our true passions and be guided by our internal North Star.

To live a life based on what society expects of us is a tragedy. Life is all about choices, and we need to ruthlessly eliminate activities that aren’t in line with our true purposes and passions.

• Build trust — Charlie Munger also cites reliability as one of the key traits for success. Woody Allen has said that 80% of success in life is just showing up. Trust is earned when action meets words. Make it a habit of underpromising and overdelivering.

Baid states, “we build trust by being honest in our communications. By being authentic and sincere in both words and actions. By being transparent and admitting mistakes and sharing what we learn. By being reliable and fair in our dealings with others.

Over time, as you build your network, put in your best efforts to constantly add value to others, you build a seamless web of deserved trust.”

• Journal — The process of structuring our thoughts into a journal brings clarity to our thinking.

It helps us overcome hindsight bias, focus our thoughts, and retain what we read. A periodic review of our investment journal helps us to avoid common mistakes and will improve our investment performance over time.

Wrapping up

Tell us know readers — What are your favorite takeaways from our discussion of Gautum Baid?

Just hit reply to this email to let us know!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.