Atomic Age (2.0)

6 September 2022

Howdy, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

🏖️ Markets were closed yesterday so Wall Streeters could have one last summer beach party at their homes in the Hamptons.

Now they’re back, though, and there’s no shortage of geopolitical and financial market concerns for them to fixate on.

🏈 For many Americans, their focus is on the NFL’s return this Thursday — Prepare your fantasy rosters accordingly.

In other news: while gasoline prices in the U.S. are expected to fall below $3 soon, the oil-producing alliance, OPEC+, has decided to cut its production targets, after briefly boosting them last month following a visit from President Biden.

And for the first time since the 1970s, price caps are back in vogue, as governments, particularly in Europe, seek to alleviate high electricity prices.

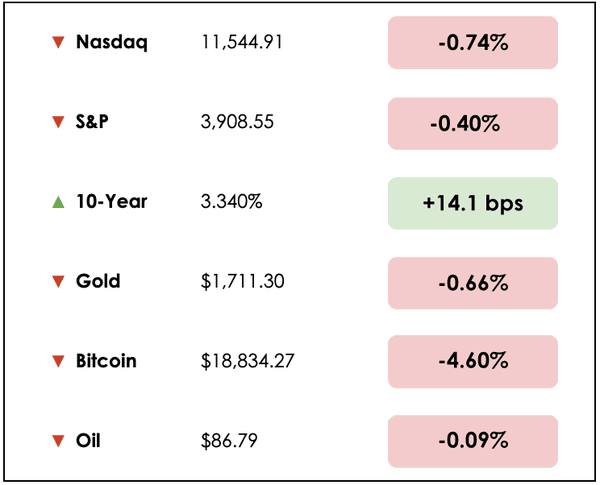

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss a boost in buying power for Americans, price caps on natural gas, a “Lehman Brothers” moment in Europe, and a possible revival of the nuclear age.

All this, and more, in just 5 minutes to read.

Today’s newsletter is heavily focused on energy markets — Here we go! ⬇️

IN THE NEWS

💵 Strong Dollar Lifts Buying Power of Americans (WSJ)

Explained:

- U.S. consumers’ relative purchasing power hasn’t been this high in over twenty years despite the backdrop of ongoing inflation.

- The Real Effective Exchange Rate, which is calculated by the Bank of International Settlements (BIS), measures the dollar’s strength against a group of key international trading partners. The BIS rate takes into account inflation rates in each country to provide a broader assessment of a country’s relative purchasing power.

What to know:

- The dollar’s strength makes imports cheaper while lifting the cost of U.S. goods sold abroad, thus hurting exporters and adding to inflation elsewhere.

- The dollar ranked behind only natural gas as the best performing asset in August. The dollar climbed past parity for the first time in twenty years against the euro. It traded against the Japanese yen at 140.42, its lowest level since 1998. It is up 13% for 2022 on the WSJ Dollar Index.

- Inflation has hit U.S. consumers hard, though, and has hurt wallets at the gas pump, grocery store, and car lot. High prices have been more benign in the U.S. than in Europe, where inflation rose to a record in August while England’s annual inflation rate has soared into double digits.

⛽ Brussels Outlines Plans For EU Price Caps On Gas (FT)

Explained:

- The European Commission in Brussels outlined a plan to put price caps on wholesale gas prices from Russia to tackle an increasingly severe energy crisis and curb inflation. Wholesale electricity prices have skyrocketed because they are linked to the price of gas, which is ten times higher than a year ago.

- There are two options for implementing the price cap. One involves limiting what can be paid for gas imported from Russia. According to the commission, one goal of the price cap would be to limit Moscow’s income from exports for funding its war against Ukraine.

- A second option would introduce a capping system that would differ from country to country depending on their energy mix.

What to know:

- Commission President Ursula von der Leyen said, “Putin is using energy as a weapon by cutting supply and manipulating our energy markets. He will fail. Europe will prevail.”

- Sweden and Finland sounded the alarm over the weekend by introducing measures to bail out power producers and traders facing higher collateral demands from banks due to volatile electricity prices.

- We question how effective a price cap from the eurozone will be as Russia has other non-European trading partners that likely will be willing to pay market rates or not impose sanctions on oil shipments. It could be shaping up to be a cold, dark winter for Europe.

🛢️Energy Trading Margin Calls Of $1.5 Trillion (Bloomberg)

Explained:

- European energy trading is being strained by margin calls of at least $1.5 trillion, prompting calls for governments to provide more liquidity buffers.

- The biggest energy crisis in decades is sucking up capital to guarantee trades amid wild price swings.

- While the physical spot market is functioning, the concern is focused on energy derivatives trading, where the $1.5 trillion in paper trading is considered “conservative,” according to Norway’s energy company, Equinor ASA.

What to know:

- European Union energy officials are being pushed to intervene to prevent energy markets from stalling, while governments across the region are set to backstop struggling utilities.

- The extra collateral being required by banks to meet margin calls is forcing many utilities to secure multi-billion euro credit lines, while rising interest rates add to costs.

- Finland warned over the weekend of a “Lehman Brothers” moment, as power companies face sudden cash shortages. As a result, Finland and Sweden announced a $33 billion emergency liquidity facility to backstop utilities through loans and credit guarantees.

DIVE DEEPER: THE NUCLEAR OPTION

For the last year or so, we’ve been tracking the uranium market on the thesis, generally, that nuclear energy will play an increasingly important role in the global transition away from fossil fuels.

With added urgency due to Russia’s invasion of Ukraine and the related energy crisis in Europe, it’s a particularly important time to explore further this investment idea.

We found great insights on the topic, while perusing Seeking Alpha, from a professional investor who writes under a pseudonym and confirmed that he’d like to uphold his anonymity after speaking with us.

Breaking it down

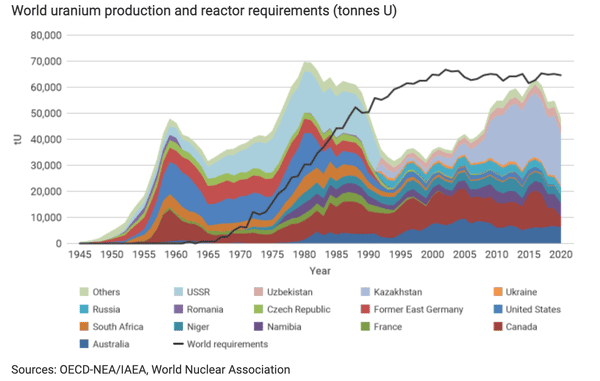

In his post, the author explains that the physical uranium market has mostly been in deficit since the 1990s. That is, more uranium is consumed each year than is produced.

Nuclear reactors power about 10% of the world’s energy consumption and 20% of the United States’ energy mix. Currently, uranium is the only commodity that can be used to power nuclear energy.

At some point, it seems almost certain that uranium prices will have to rise to incentivize new miners to enter the space and supply enough of the commodity to close imbalances. This would mean rising above the marginal cost of production.

Current spot prices are actually below the cost of production for many new undeveloped mining sources. This is why it’s believed that the depressed prices at present are simply unsustainable, if, at a minimum, demand for uranium (primarily from nuclear reactors) remains relatively constant.

Should we see a rejuvenation of the nuclear movement, especially in the West, where there’s tremendous political support for energy production that avoids carbon emissions yet dire dependence on oil & gas still, as we’ve learned this year, then the bull thesis for uranium is magnified.

The timeline for this rally is quite uncertain though, since it’s difficult to gauge the size of secondary sources and stockpiles, as governments aren’t keen to disclose this strategically sensitive information.

Catalysts

The post highlights further that demand for uranium is quite inelastic, because fuel costs for nuclear power plants are a negligible percentage of total operating costs, so these purchasers of uranium may be largely price insensitive.

This means that the price of uranium could meaningfully overshoot levels needed to induce new mining production, due to supply also being inelastic, meaning it takes years for new uranium mines to come online again even if prices rocket higher.

This is, in part, due to the significant environmental regulations that surround the radioactive metal. These make the permitting processes and operations for new miners challenging to navigate.

On top of this, commodity trusts are purchasing uranium in spot markets and storing the supplies indefinitely, which further reduces the amount available to energy producers, in addition to the chronic mining deficit.

Sprott Trust

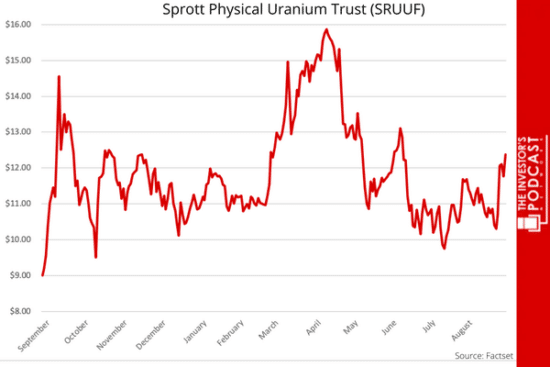

The most well-known is the Sprott Physical Uranium Trust.

When new shares in the trust are created, it’s forced to passively accumulate more uranium and reduces the available supply of the already limited metal.

The trust is long only, so they’re not trading the price of uranium, but instead, all uranium that’s purchased is essentially removed from circulation into permanent storage.

Since its inception in July of 2021, the trust has put away over 57 million pounds of uranium —that’s about 45% of annual production.

Below is the trust’s price performance over the last year.

Limited supply

The Sprott mechanism for uranium purchases and storage creates a positive feedback loop that constrains supply, which pushes prices higher and attracts more investors to the space. This means greater capital flows into the trust are then used to buy even more uranium.

Recently, inflows into the space have been hindered by the broader market selloff this year, in addition to the Sprott trust’s application for listing on the NYSE being rejected by the SEC.

Currently, the trust has two listings in Canada (U.U and U.UN) while also trading over-the-counter under the ticker SRUUF.

Negative sentiment, then, has enabled the trust’s shares to trade at a discount to its net asset value. For speculators, this creates an opportunity to invest in uranium directly, early in its bull market.

Moreover, with input costs rising broadly stemming from high rates of inflation, marginal costs of production are continuing to rise, so new mining projects are further disincentivized from bringing new supply to markets without a considerable increase in the price they can sell the uranium for.

Other catalysts for the spot price of uranium relate to around 40% of supply coming from Kazakhstan, a Russian ally that exports uranium products through St. Petersburg.

Should Western sanctions target these supplies or should any turmoil domestically in Kazakhstan disrupt production, the uranium price would likely benefit dramatically.

Rising Demand

It’s believed by many in the energy and nuclear space that for countries to reach their net-zero emissions commitments, sizable investments will have to be made in new reactors that would add to uranium demand.

On this note, France has announced the construction of six new reactors, while China seeks to increase its nuclear capacity 40% by 2025, and most recently, the Prime Minister of Japan made headlines that the country would restart nuclear reactors and facilitate the construction of new plants for the first time since the 2011 Fukushima crisis.

So it does appear that demand for nuclear energy, and therefore uranium, is trending up in response to a number of global crises today.

Upside

The uranium market is very small, though, and it appears locked in a structural shortage. As the need for nuclear energy becomes more apparent, so does the demand for uranium.

Considering the commodity’s depressed price relative to supply levels and the cost of new production, plus the size and limited liquidity in trading it, a squeeze on its price could be quick and dramatic.

In the last uranium bull market ending in 2008, prices flew from around $10 per pound to over $130.

The difficulty is in timing it. If we knew the answer, we’d probably be doing something more lucrative than writing newsletters (which we love to do by the way).

Uranium market expert Justin Huhn says we are still only in the early innings of this story, perhaps the second or third he believes, but how long this bull case

takes to unfold is both important and uncertain.

Wrapping it up

To invest directly in the commodity, the Sprott Uranium Trust is an excellent option, and the Sprott Uranium Miners ETF (URNM) or Global X Funds’ ETF (URA) represent other possible ways to participate in the trend (less directly and with equity risks).

There’s a lot more to understand — the energy markets and nuclear power are big topics, but this is hopefully a useful introduction to the topic.

To read the full research post, you can find it here.

Our own Clay Finck did a podcast on this topic as well with Justin Huhn for Millennial Investing.

And for more investing ideas like this, we love Seeking Alpha, where tons of brilliant investors share their insights daily on the opportunities they’re watching.

If you want to see for yourself, you can use our sign-up link for a special discount 😉

For full transparency, we do hold a small position in the Sprott Uranium Trust, and we recommend that you do your own research before making any decisions.

ONE MORE THING

Our editor, and host of the Real Estate 101 podcast, Robert Leonard, just published his new book, The Everything Guide to House Hacking.

Join us in congratulating him! 🎉

For anyone interested in building wealth through real estate with easy-to-follow steps, this is surely an excellent resource.

We are proud to see our colleague achieving such great things, and we hope you’ll check the book out.

More on it (and “house hacking” generally) tomorrow.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.