Intrinsic Value Assessment Of Pointer Telocation Ltd. (PNTR)

By David J. Flood from The Investor’s Podcast Network | 26 September 2018

INTRODUCTION

Pointer Telocation Ltd. is an Israeli-based communication equipment company whose principal business involves providing command and control technologies for Mobile Resource Management (MRM). At the time of writing, the firm’s market cap stands at around $105 Million and its revenues and free cash flows for the previous financial year were around $78 Million and $6 Million respectively. The company’s common stock has fluctuated between a high of $19.65 and a low of $10.25 over the past 52 weeks and currently stands at $12.90. Is Pointer Telocation Ltd. undervalued at the current price?

THE INTRINSIC VALUE OF POINTER TELOCATION LTD.

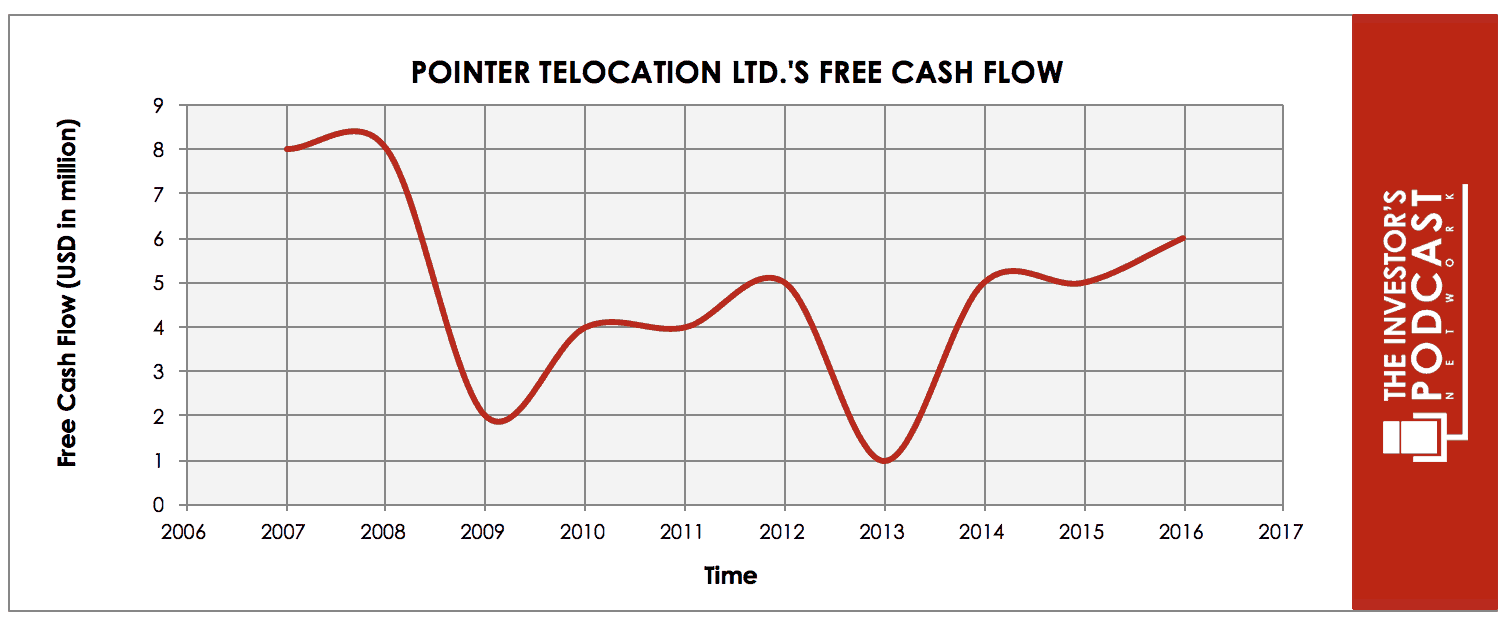

To determine the intrinsic value of Pointer Telocation Ltd., we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Pointer Telocation Ltd.’s free cash flow for the past ten years.

As one can see the company’s free cash flow has been erratic over the past decade which is the result of cyclical fluctuations in the company’s business. In order to determine Pointer Telocation Ltd.’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

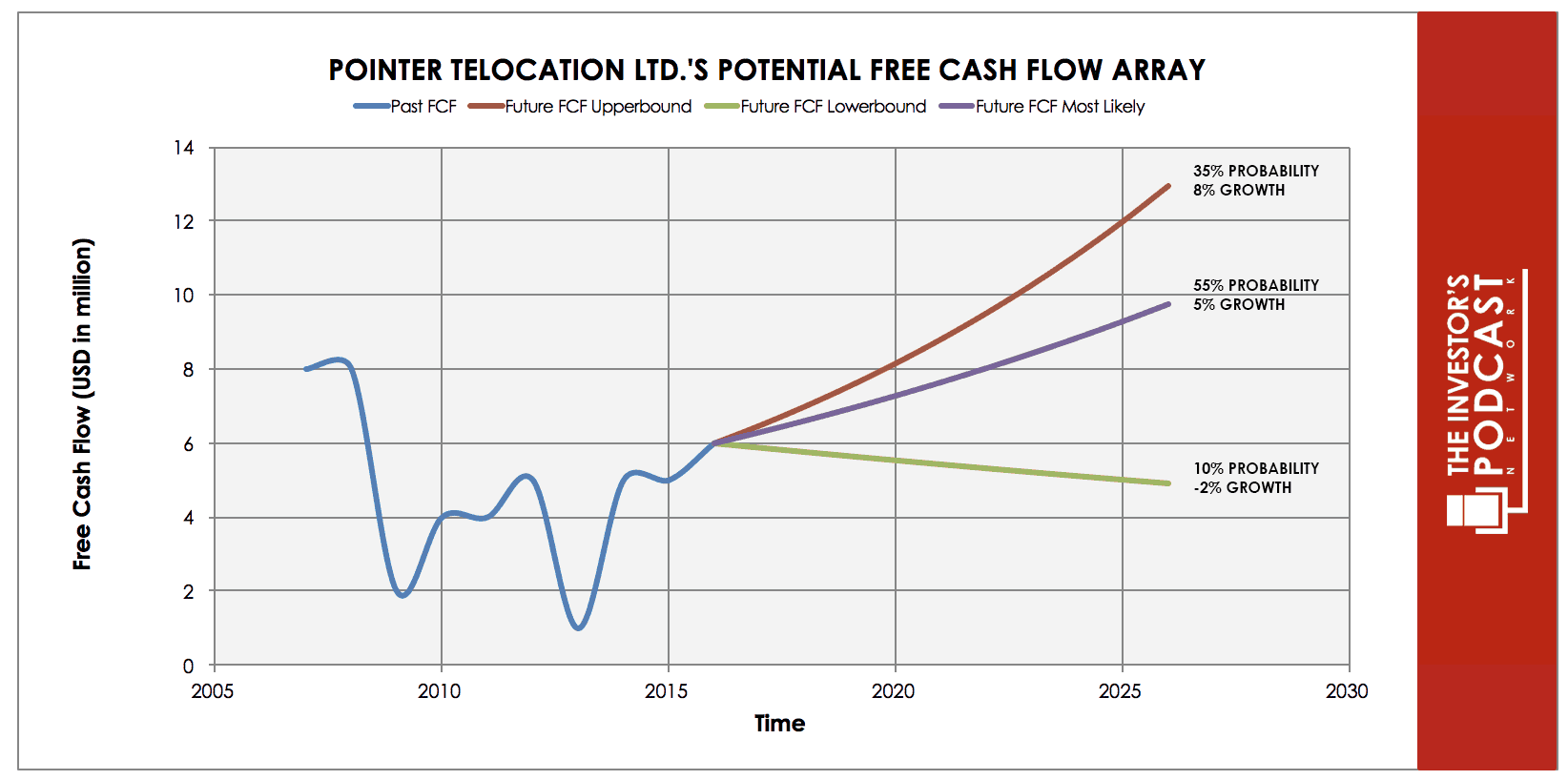

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents an 8% growth rate which assumes that the firm’s future free cash flow growth increases beyond its long-term historical average of 4.57%. This assumption is based on the fact that the company has achieved significant development over the past 18 months to become a proprietary technology company with increased growth prospects including a contract win with Nissan India and a recurring $2-3 Million U.S. contract for the firm’s CelloTrack Nano product. As such, this upper growth line has been assigned a 35% probability of occurrence.

The middle growth line represents a 4.57% growth rate which is based on the company’s historical free cash flow growth rate for the period 2005-2017. This future growth rate assumes that the firm continues to grow in line with its historical average and that recent developments of increasing growth are not sustained, it has been assigned a 55% probability of occurrence.

The lower bound line represents a -2% rate in free cash flow growth and assumes that the company suffers a contraction in earnings due to competitive and cyclical pressures. This growth rate has been assigned a 10% probability of occurrence.

Assuming these potential outcomes and corresponding cash flows are accurately represented, Pointer Telocation Ltd. might be priced at a 7.2% annual return if the company can be purchased at today’s price. We’ll now look at some other valuation metrics to see if they correspond with this estimate.

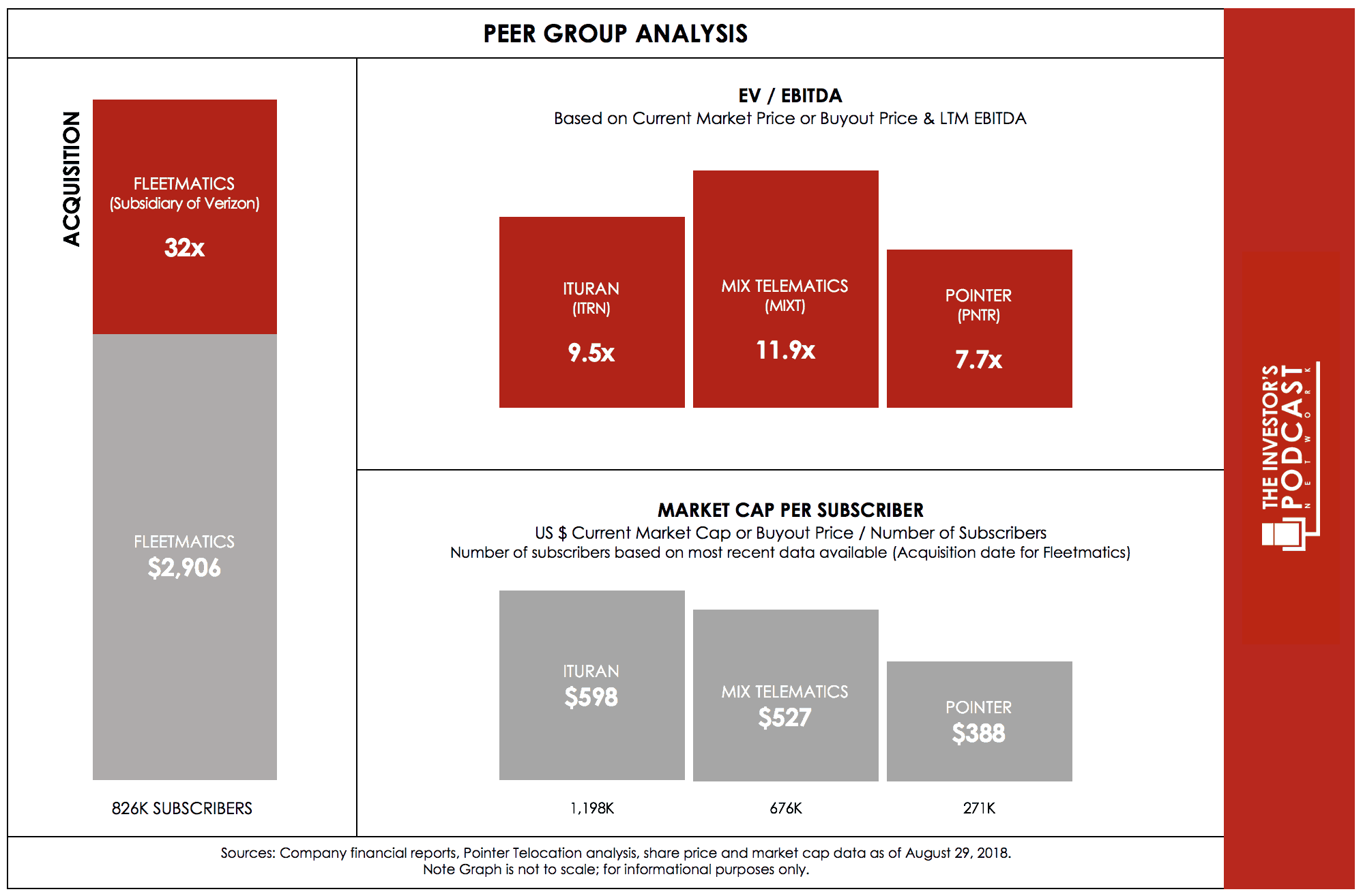

Pointer Telocation Ltd.’s current earnings yield, which is the inverse of its EV/EBIT ratio, is 10.44% which is above the industry median of 2.73%. This suggests that the firm is undervalued relative to the industry. Specific peer group analysis suggests that the firm is undervalued on an EV/EBITDA and Market Cap per subscriber basis.

Source: PNTR 2018 Investor Presentation

Assuming a repricing congruent with current market valuations for ITRN and MIXT would yield a fair value of around $15.50 – $16.20 representing 20-35% upside from the current price.

Finally, we’ll look at Pointer Telocation Ltd.’s free cash flow yield, a metric which assumes zero growth and simply measures the firm’s trailing free cash against its current market price. At the current market price, Pointer Telocation Ltd. has a free cash flow yield of around 6.9%.

Taking all these points into consideration, it seems reasonable to assume that Pointer Telocation Ltd. may currently be trading at a discount to its peers and the global communications equipment market. Furthermore, the company may return between 7-8% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these estimated free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF POINTER TELOCATION LTD.

Pointer Telocation Ltd. has various competitive advantages outlined below.

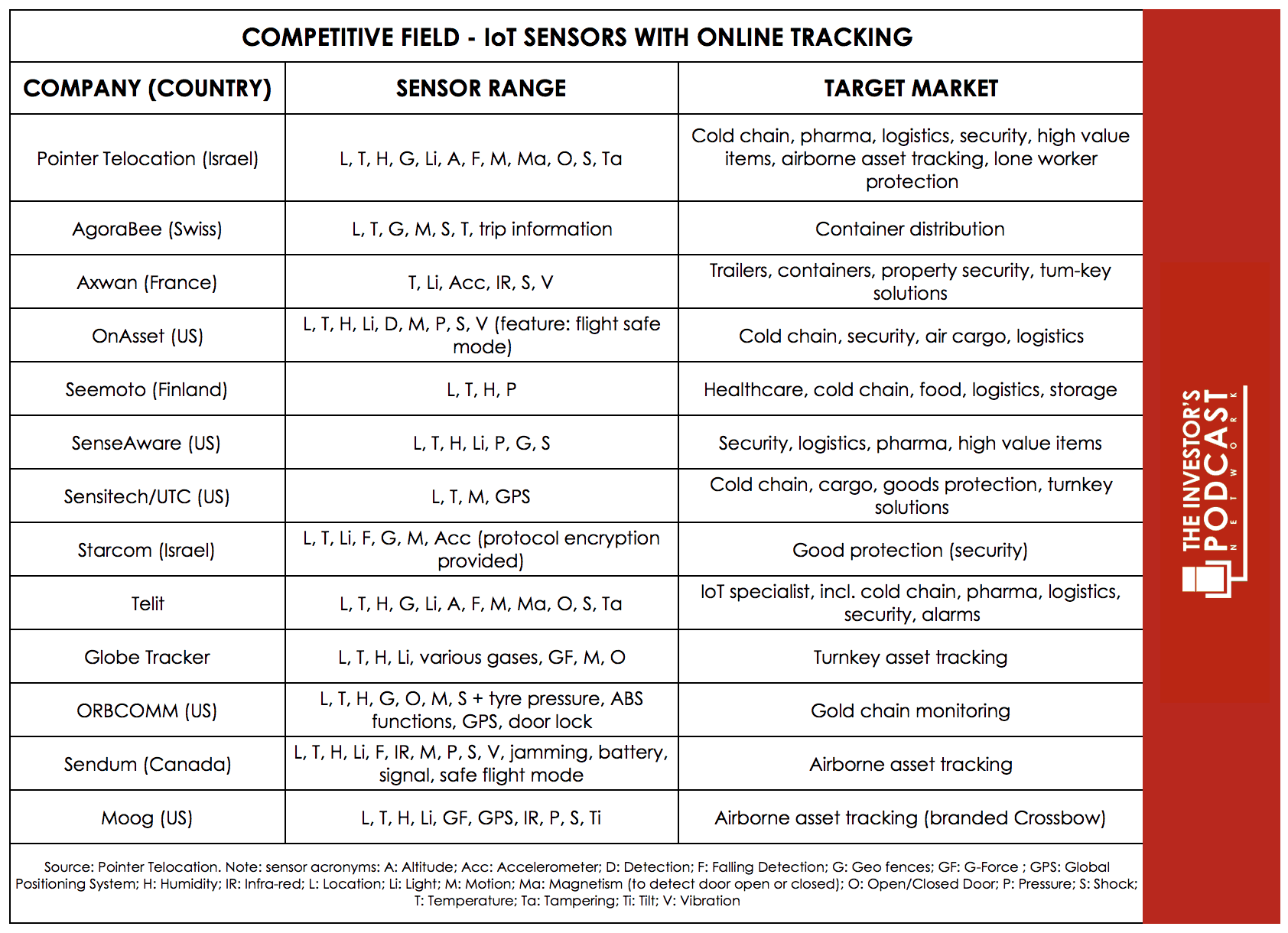

- Barriers to Entry. Pointer Telocation Ltd.’s products comply with cold chain monitoring regulations for use in food (EN 12830) and pharmaceuticals (GDP) cargo. They are also certified as compliant with FAA and IATA rules on airborne asset tracking and cold chain logistics and recently received AIS 140 Indian ITS standard certification. These regulatory requirements create barriers to entry which limits the number of competitors likely to emerge. The chart below shows how the company’s products and services are approved across multiple target markets.

Source: Edison Research Analysis, PNTR, March 2018

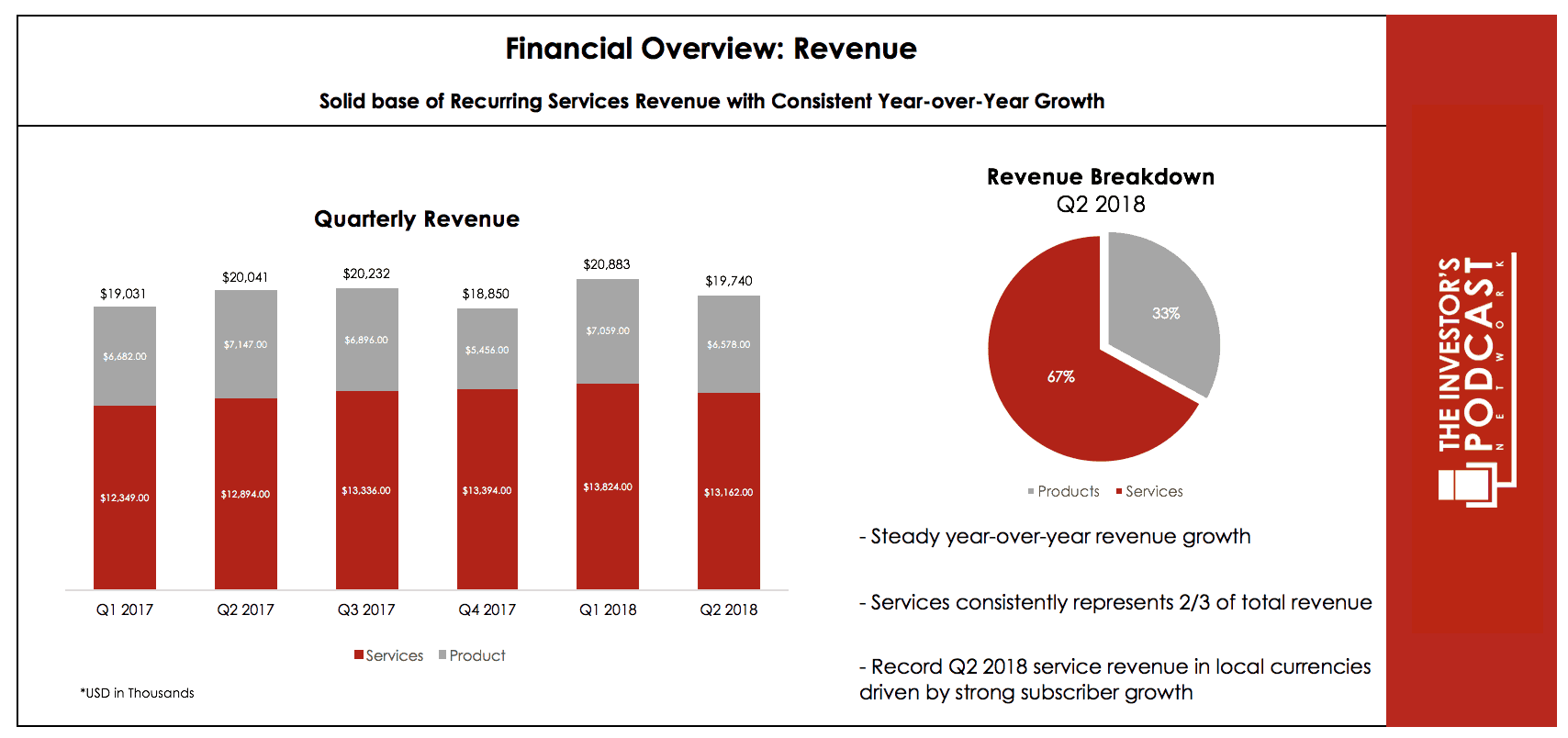

- High Switching Costs. Pointer Telocation Ltd. is consistently deriving around 67% of revenue from recurring services revenue. This suggests that the firm’s customer base is “locked in” with high switching costs leading to ongoing services revenues.

Source: PNTR 2018 Investor Presentation

- Niche Attribute. Pointer Telocation Ltd. has 18 years of experience in the MRM market, in which time it has built significant market positions in underserved developing markets such as Israel, Brazil, Argentina, Mexico, and South Africa. At present, the company has 3 million units installed across 80 countries with a broad client base in place.

Source: PNTR 2018 Investor Presentation

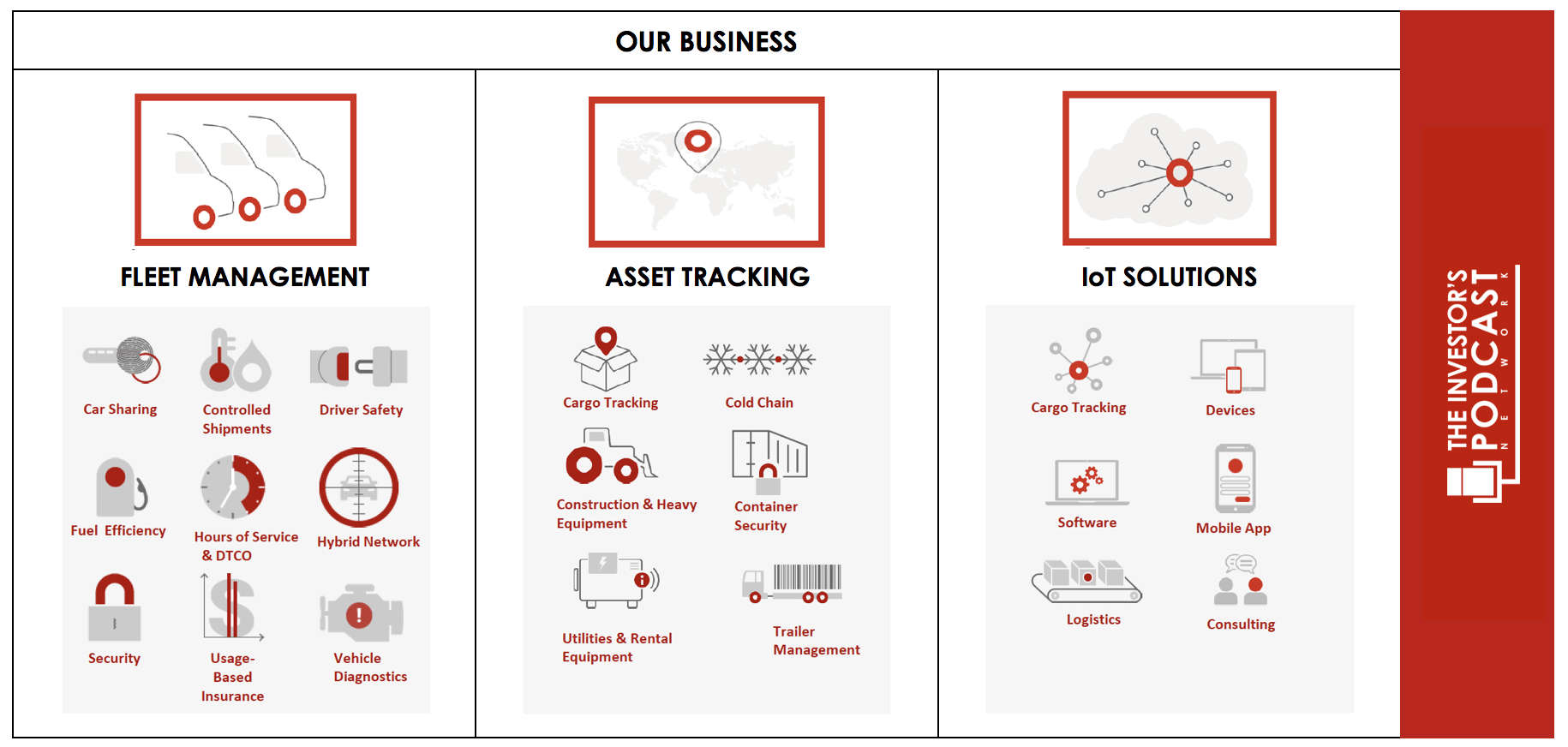

The company is able to offer a tailored service to its customers which includes fleet management, advanced diagnostics, and driver monitoring. These products and services are a powerful value proposition since they save customers time and money by highlighting inefficiencies and potential cost savings.

Source: PNTR 2018 Investor Presentation

POINTER TELOCATION LTD.’S RISKS

Now that Pointer Telocation Ltd.’s competitive advantages have been considered, let’s look at some of the risk factors that could impair my assumptions of investment return.

- The Mobile Resource Management (MRM) market is cyclical in nature with MRM product sales tied to new vehicle sales and replacement cycles, both of which are themselves subject to cyclical pressures such as economic activity and interest rates. The emergence of an economic downturn would thus likely have a negative impact on Pointer Telocation Ltd.’s revenues and earnings.

- While Pointer Telocation Ltd. reports in U.S. Dollars, the majority of its revenues are derived from its operations in Israel, Brazil, Argentina, and This gives rise to currency risks in which a strengthening U.S. Dollar and weakening EM currencies are likely to negatively impact the company’s financial performance in the near to mid-term.

- At present, Pointer Telocation Ltd. has an unprovisioned tax claim of $11.5 Million in Brazil. The Brazilian Tax authorities are claiming that the firm’s Brazilian subsidiary is a telecom company and is thus subject to a higher rate of tax. Pointer Telocation Ltd.’s management rejects this assertion and, under the instruction of their lawyers, have not made provisions for this claim. The firm’s legal counsel expects the figure to reduced substantially through negotiation but warns that the issue may take years to resolve.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At the time of writing, 10-year treasuries are yielding 3%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of 33.6 which is 98.8% higher than the historical mean of 16.9. Assuming reversion to the mean occurs, the implied future annual return is likely to be -3.4%. Pointer Telocation Ltd., therefore, appears to offer a much better return for investors at present, but other individual stocks may be found which offer a similar return relative to the risk profile.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 33.6. This is 98.8% higher than the historical average of 16.9 suggesting that markets are at elevated levels. U.S. unemployment figures are at a 30-year low suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 202.80% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

Pointer Telocation Ltd. appears to be selling at a discount to its peers for a number of reasons including investor sentiment regarding the company’s growth prospects and the currency risks associated with the firm’s business. Given that the company is a small cap firm with business operations focused around emerging markets, investors should not be too hasty to disregard these concerns. There also exists the issue of an unresolved tax claim from the Brazilian authorities which cannot be neglected by investors considering this potential investment.

There are, however, a number of positive developments and tailwinds which have the potential to facilitate significant future growth for the company. Telematics’ demand in emerging markets has so far lagged that of their developed counterparts, but this is likely to change in the future as regulatory catch-up occurs. The Mobile Resource Management (MRM) is currently valued at $55 Billion and is set to grow by 32% CAGR through 2020 and 24% CAGR through 2022.

Source: PNTR 2018 Investor Presentation

Research firm Berg Insight has noted that MRM penetration of non-privately-owned commercial fleets in the U.S. was only 23% in 2016 but is projected to increase to 41.7% by 2021. The same metrics for Latin America is 10% to 17%. This translates to a market CAGR of 15% in the US and 13% in Latin America.

Pointer Telocation Ltd. has grown its subscriber base at an annualized rate of 18% since 2015, and this trend looks set to continue as the company leverages new products in its Internet of Vehicles (IOV), logistics, and Advanced Telematics segments to increase its user base and sell additional services to existing users.

Source: PNTR 2018 Investor Presentation

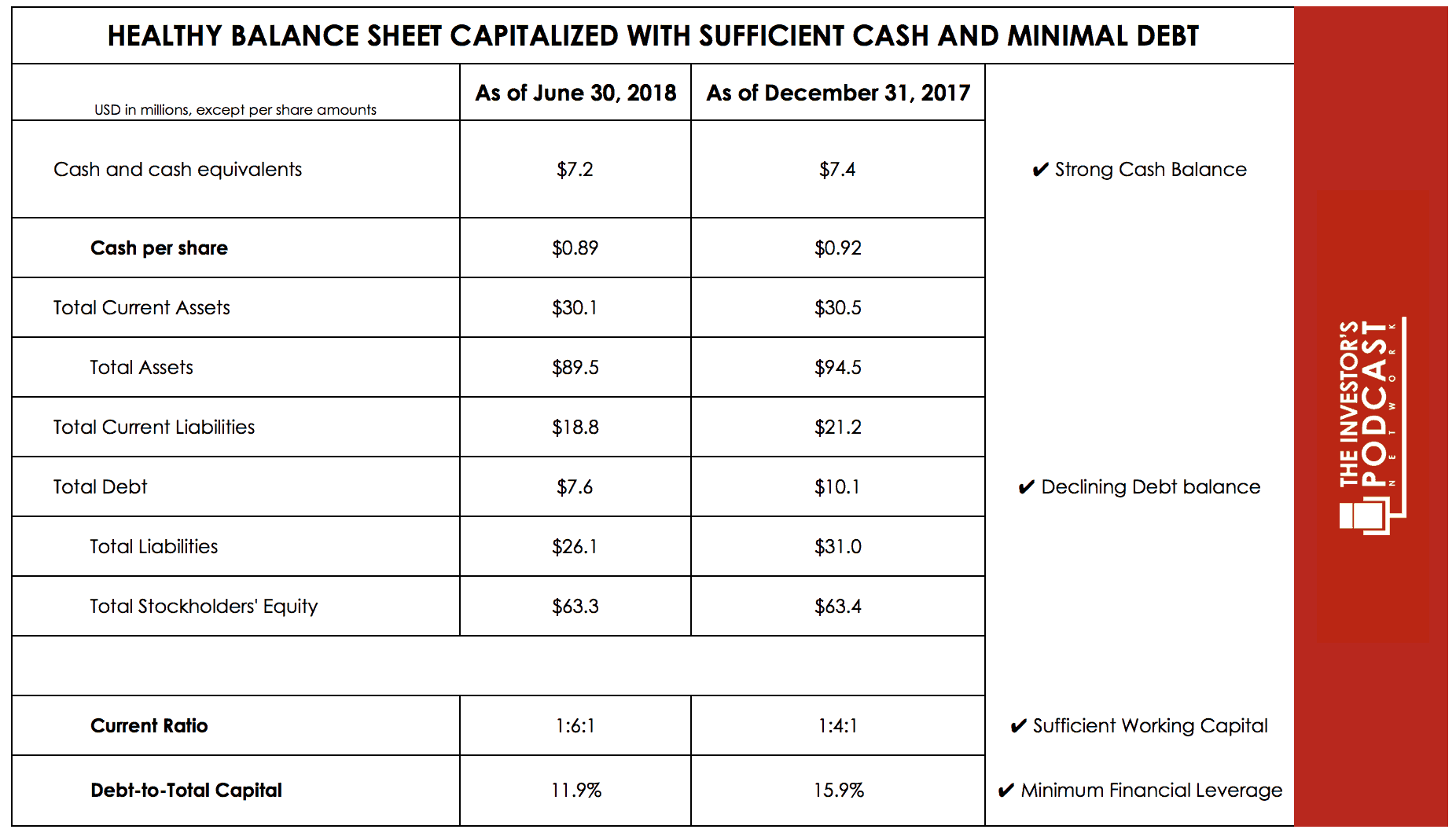

With regards to financial stability, the firm is currently in a moderately robust position with a debt/total capital ratio of 11.9% and a current and quick ratio of 1.61 and 1.31 respectively. Cash and equivalents currently stand at $7.2 Million meaning the possibility for accretive acquisitions without recourse to debt financing are open along with the potential for future dividend distributions.

Source: PNTR 2018 Investor Presentation

In summary, Pointer Telocation Ltd. appears to be a financially stable company with numerous potential growth prospects. The firm currently possesses a narrow economic moat stemming from high switching costs which are likely to be maintained in the near-to-mid-term. However, this may begin to erode if Telematics becomes integrated early in the production chain through factory installations. Investors should assume that fluctuations in revenues and earnings will continue and that volatility in share price is likely to occur given the cyclicality of the company’s business operations and its exposure to currency risks and emerging markets.

Based on the conservative assumptions used in the analysis of the company, Pointer Telocation Ltd. may return around 7-8% at the current market price.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold fractional ownership in any of the companies mentioned at the time of writing this article.