Intrinsic Value Assessment Of CVS Health Corporation (CVS)

By David J. Flood From The Investor’s Podcast Network | 27 February 2018

INTRODUCTION

CVS Health Corporation is an American retail pharmacy and healthcare company whose operations are divided into two segments, namely retail and long-term care and pharmacy services. Its lines of business involve the distribution of pharmaceuticals at the retail level. It also provides medical supplies, health information technology, and care management products. CVS Health Corporation is currently ranked 7th on the Fortune 500 list with a market cap of $69.15 Billion. Its revenues and free cash flows for the previous financial year were around $184.76 Billion and $6 Billion respectively. The company’s common stock has fluctuated between a low of $66 and a high of $84 over the past 52 weeks and currently stands at around $68. Is CVS Health Corporation undervalued at the current price?

THE INTRINSIC VALUE OF CVS HEALTH CORPORATION

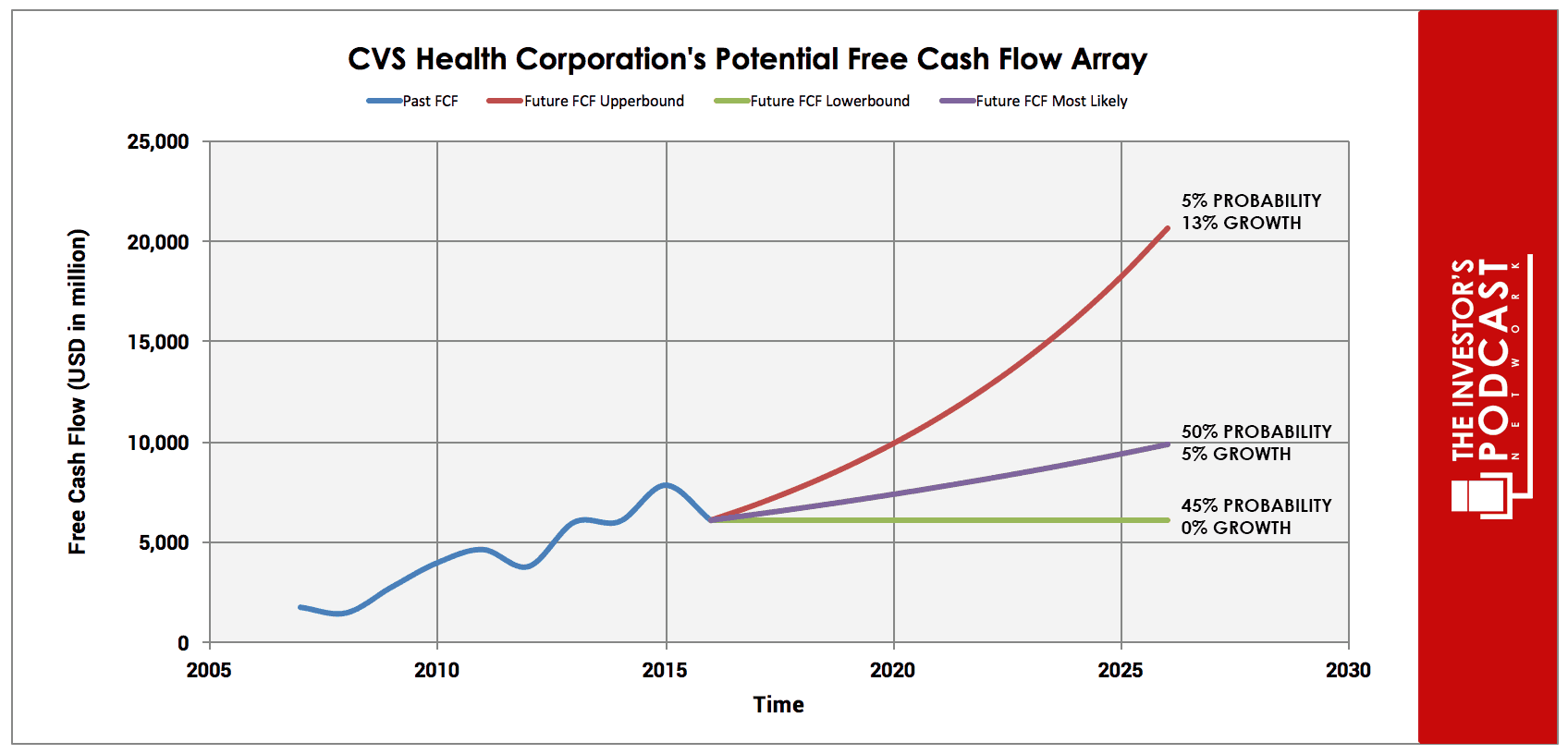

To determine the intrinsic value of CVS Health Corporation, we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of CVS Health Corporation’s free cash flow for the past ten years.

As one can see, the company has generated strong growth in free cash flow over the past decade with an annualized growth rate in free cash flows of around 15%. In order to determine CVS Health Corporation’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents a 13% growth rate. This is based on the company’s 10-year historical free cash flow growth rate less 2% to account for the uncertainty pervading the industry at present. This has been assigned a 5% probability of occurrence as the potential for regulatory and competitive pressure is currently high.

The middle growth line represents a 5% growth rate. This is based on CVS Health Corporation’s historical revenue growth rate less 4%, which is a much more stable and conservative estimate. For this reason, it has been given a 50% probability of occurrence. The lower bound line represents a 0% growth rate in free cash flow and has been assigned a 45% probability of occurrence. This lower bound rate assumes that the company’s future free cash flow growth is indeed impacted by regulatory and competitive pressures as explained under “risks” below. Assuming these potential outcomes, and that corresponding cash flows are accurately represented, CVS Health Corporation might be priced at a 10.1% annual return if the company can be purchased at today’s price. We’ll now look at some other valuation metrics to see if they correspond to this estimate.

Based on CVS Health Corporation’s current Earnings yield, which is the inverse of its EV/EBIT ratio, the company is projected to return around 9.90%. We’ll now look at how this compares to both the global industrial average and the company’s historical average Earnings yield to see how it corresponds. Using a 10-year median average as our benchmark, the company’s historical earnings yield comes out at 9.10%, and the current global industrial median average is 7.75%. Taking these points into consideration, it seems reasonable to assume that CVS Health Corporation is undervalued relative to its peers and the market’s historical valuation for the company.

We’ll now look at the company’s current free cash flow yield, which is the inverse of its present P/FCF ratio, to see how this compares to the other valuations. At present, CVS Health Corporation has a free cash flow yield of around 8.5%. Taking all these points into consideration, it seems reasonable to assume that the company may return around 8-11% at the current price. Now, let’s discuss how and why these estimated free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF CVS HEALTH CORPORATION

CVS Health Corporation has various competitive advantages outlined below.

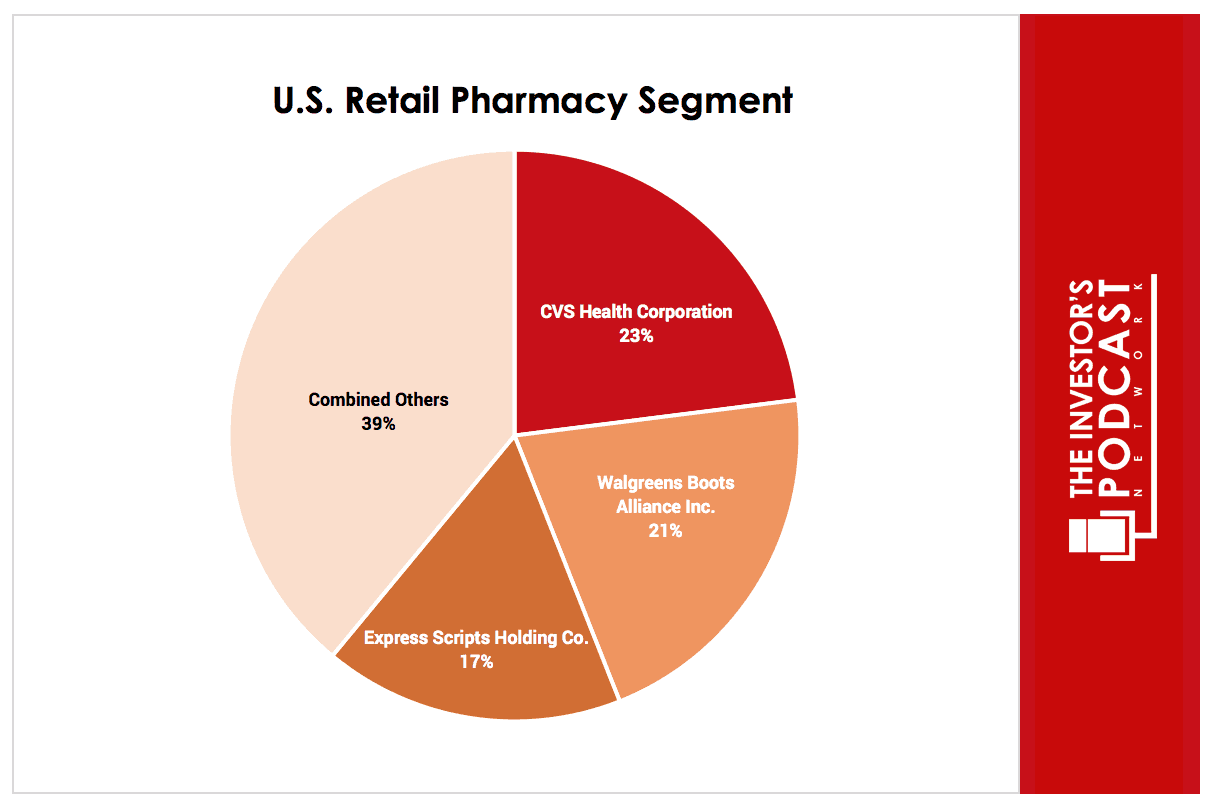

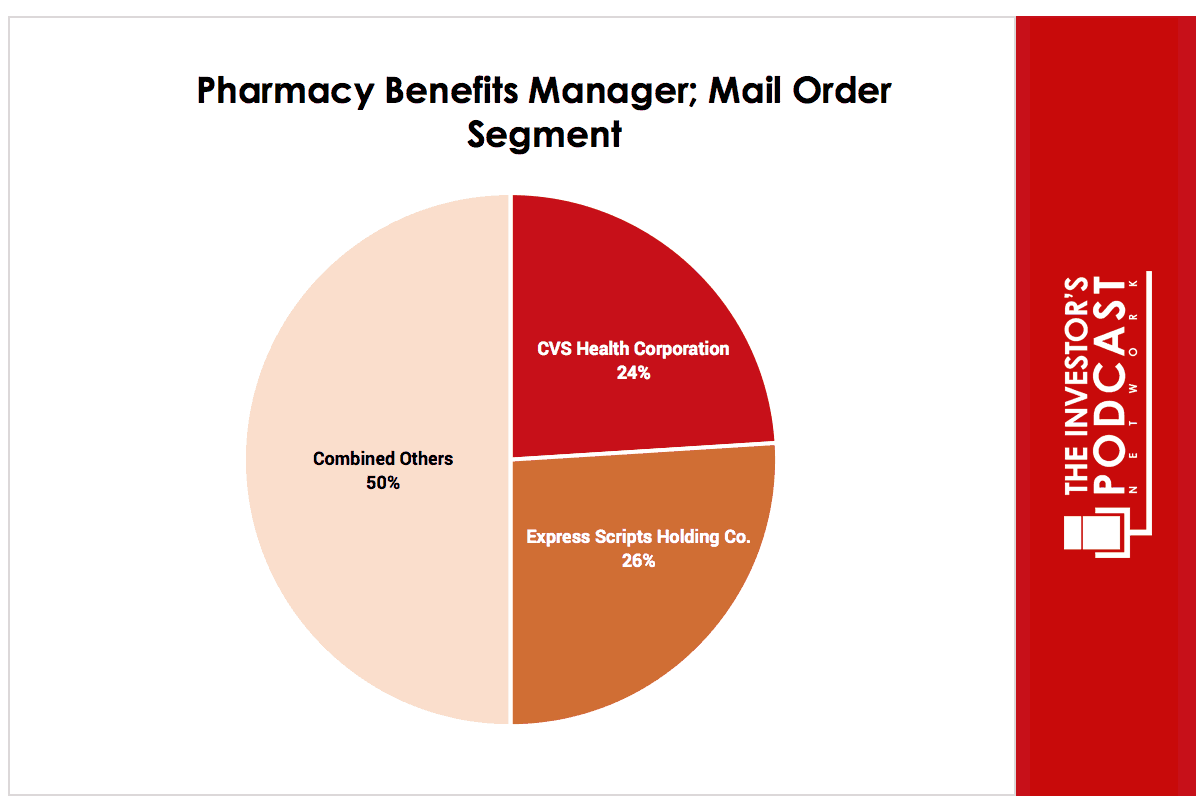

- Oligopoly Power. CVS Health Corporation, along with two of its major competitors, Walgreen Boots Alliance Inc. and Express Scripts Holding Co., forms an oligopoly which collectively controls over 60% of the U.S. retail pharmacy segment. CVS Health Corporation extends this dominance into the U.S. PBM mail order segment of which it holds a market share of around 24% with Express Scripts Holding Co. accounting for around 26%.

Figure 1: Source; CSI Market Estimates 2017

Figure 2: Source; CSI Market Estimates 2017

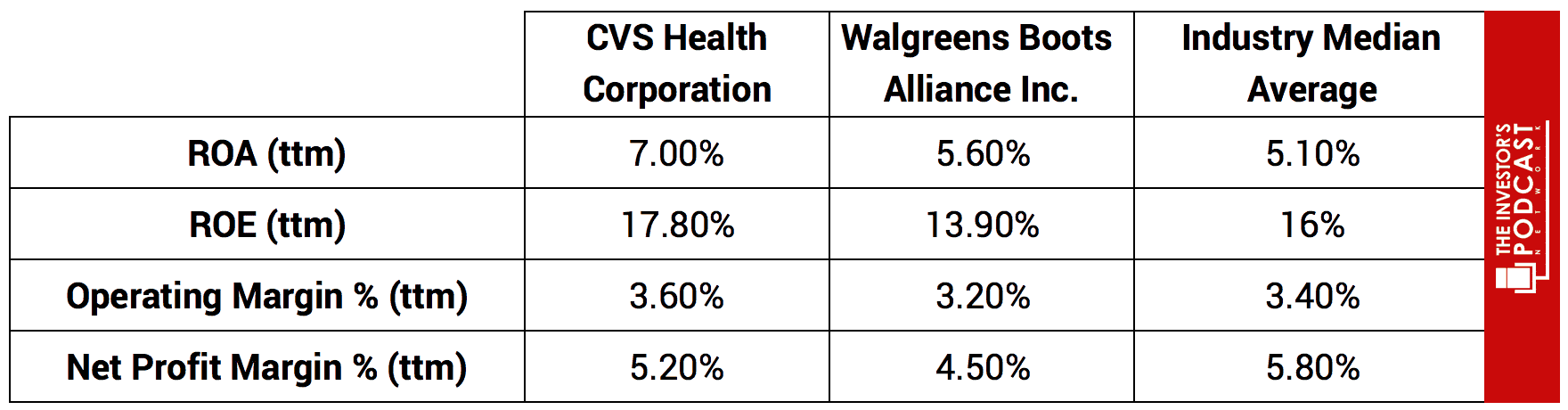

- Economies of Scale. Since CVS Health Corporation is one of the largest pharmacy retailers/PBMs in the U.S., it possesses strong bargaining power to obtain favorable drug prices for its customers. Through the acquisitions of Omnicare and Target’s pharmacies, the firm has increased its scale of operations which in turn leads to cost savings. These economies of scale allow the firm to outperform its closest competitor and the industry median average on a number of key metrics.

- CVS Health Corporation possesses synergies through a combined strategy by operating as a pharmacy retailer, PBM, and through its retail clinics. The proposed acquisition of Aetna would further strengthen its position as this vertical merger would add another piece to its supply chain. CVS has estimated that the merger could result in synergies of $750 Million through streamlining, cost savings, and an increase in volume and market share.

CVS HEALTH CORPORATION’S RISKS

Now that CVS Health Corporation’s competitive advantages have been considered, let’s look at some of the risk factors that could impair my assumptions of investment return.

- Rumors continue to circle that Amazon will make a move in the pharmacy market. This would be a significant disruption for established players such as CVS Health Corporation. While it appears to be a difficult task from a logistical point of view, there is no doubt that Amazon’s ambition and resources may come to the fore.

- CVS Health Corporation is also facing increasing regulatory pressure from federal and state governments which could impact reimbursements leading to lower profits. CVS may also face anti-trust pressure if the Aetna merger goes through as it is already in the process of forming a new PBM with Anthem. Given Aetna and Anthem are amongst the top 3 largest health insurers in the U.S., an anti-trust case could have merit.

- There is no guarantee that the proposed Aetna merger will go through as it still requires approval from the DOJ. Should this approval be denied, this would put CVS in a weaker position to face possible competition from Amazon and from established players who are looking to add the insurer component to their supply chain.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At present, 10-year treasuries are yielding 2.87%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of x 33.2 which is 97.6% higher than the historical mean of 16.8. Assuming reversion to the mean occurs, the implied future return is currently 3.2%. CVS Health Corporation, therefore, appears to offer a much better return for investors at present, but other individual stocks may be found which offer a similar return relative to the risk profile.

MACRO FACTORS

Investors must consider macro-economic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 33.2. This is over 97.6% higher than the historical average of 16.8 suggesting markets are at elevated levels. U.S. unemployment figures are at a 30-year low suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

The future of CVS Health Corporation looks uncertain at present. If the company’s merger bid for Aetna is successful, this will certainly strengthen its competitive advantages to offer greater protection from established competitors such as Walgreens Boots Alliance Inc., Express Scripts Co., and United Health Group Inc. As to the threat of Amazon moving into the pharmacy retail market, only time will tell how this plays out. But from a logistical and regulatory point of view, it will be far more challenging than Amazon’s recent success in attaining licenses to distribute and sell medical supplies & instruments.

Management certainly has a good track record of being shareholder-friendly having returned $6.3 Billion to shareholders in dividends and share buybacks in 2016. Over the past ten years, the company has increased dividends at an annualized rate of 26.5%, and their current share buy-back ratio stands at 3.90%. The firm’s dividend payout ratio currently stands at around 30% meaning there is plenty of runways to increase dividends going forward but this may be tempered by the fact that the firm will be taking on significant financial obligations if the proposed $66 Billion merger deal for Aetna is successful. Management has recently announced the launch of a streamlining program with the target of $3 Billion in savings by 2021, which includes boosting efficiencies of shared services functions, optimizing their pharmacy delivery platform and reorganizing their store footprint.

The long-term demographic trends look favorable for CVS with a large increase in the aging population thanks to the baby-boomer effect. Pharmaceutical spending is projected to grow at around 5.5% for the next five years, and the implementation of the Patient Protection and Affordable Care Act should drive demand as more customers gain insurance coverage. Assuming no major disruption occurs through regulatory or competitive pressure, CVS Health Corporation could emerge stronger, particularly if its merger bid of Aetna is successfully adding another link to its supply chain and widening its moat. At the current price, CVS Health Corporation appears undervalued and may provide a return of around 10%.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.